Forex Trading Basics with Range Bars

Forex Trading Basics To Be Aware Of

Almost every day I get emails from people asking about a very specific situation in the market. They want to know how it should be handled if this exact pattern comes up again in the future. While it’s important to go back and analyze these opportunities, I often see that the trader is asking the wrong questions.

Usually they are looking at a small pattern in the market composed of only a handful of range bars but they aren’t looking at the greater market picture and considering the context in which the potential opportunity occurs. They are forgetting some of the forex trading basics. The same thing happens with time-based traders and it’s often to an even greater degree. All you have to do is look at many of the “price action” traders out there who become incredibly focused on single bars on the M5 or M15 to make decisions. This rarely ends up well in the long term. Single bars can be excellent (like hammers and shooting stars) but only if the context for the trade is right. If you are pulling the trigger based on a single bar without considering the overall structure and momentum of the market you are going to run into trouble. While using range bars does help us with the short-term momentum part of the equation we still need to take a step back at times and consider the market as a whole.

The Market Structure

If the market is in a very clear and tight range, should we be taking trades near the edge of it? Even if we can get a trade near the middle, is there a way we can minimize our risk? These are the sort of questions traders should be asking themselves throughout the day.

Reading the overall context of the market throughout the day and making plans for possible future scenarios based on it will be a huge advantage in your trading strategy. One of the greatest shifts in trading development that I often see is when traders stop focusing on ENTRIES and start focusing on SETUPS.

Reading the overall context of the market throughout the day and making plans for possible future scenarios based on it will be a huge advantage in your trading strategy. One of the greatest shifts in trading development that I often see is when traders stop focusing on ENTRIES and start focusing on SETUPS. Read the market, plan out likely scenarios, then trade your plan when quality entries present themselves. If you can do this you will learn how the market moves and what the likely outcomes will be far before they happen. It’s in this way that a trader begins to develop his “gut instinct” for trades. Those who focus on only the last few minutes rarely develop that feeling.

Gauging Market Momentum

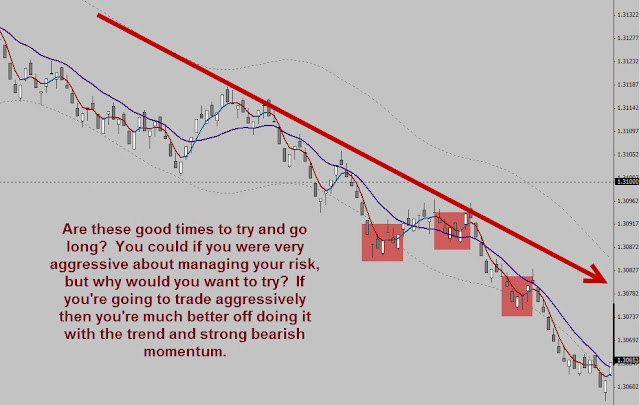

If the market has been trending very strongly in one direction most of the day, is it a good idea to fight that momentum? While in retrospect the answer is almost always an obvious “no”, in live trading this is often much more difficult. While trading it always seems extremely easy to convince ourselves that we are putting in a top or a bottom. The human ego loves to look incredibly clever by trying to catch the very edge of the market. It forgets how often it can be wrong and always looks for the next time to look good. Don’t listen and don’t fall into the trap!

We say to ourselves that “price looks so extended”, “it couldn’t possibly keep running in this direction”, or something similar. Usually when we think this way we quickly find out how wrong we were. The market is the master and you don’t have control of what it will do. As much as we want to believe the market will turn on a dime this is very rarely the case. Usually turns occur over the course of multiple attempts and an extended battle between bulls and bears.

Don’t try to outsmart the market. Consider the greater forces in effect and let the market tell you when it’s most likely ready to turn. It usually gives clear signs of the possibility if you don’t become blinded by trying to force your bias on the market. More importantly, if you guess wrong then be sure to minimize your risk as much as possible. Fighting a trend is no time to keep your risk at the maximum.

Keeping Your Discipline

Sometimes when you are watching the market for hours at a time it becomes easy to lose your focus. Novice and veteran traders alike struggle with this and maintaining focus is all about the discipline of the trader. Like anything else it’s a skill that can be developed with time and practice but being aware of it as a newer trader will help improve the learning curve. As traders we often feel a certain pressure to be active in the market. After all, if we’re not trading, are we really traders at all? This pressure can be the most difficult thing for a novice trader to overcome. Once you begin to realize that real trading is all about patience you usually begin to turn the corner to the consistency you desire.

We need to understand that our skill as a trader is defined by our ability to choose high quality trading opportunities that will provide us with an excellent expectancy. Doing this is all about patience and it is an often neglected part of the trading toolbox. If you know the types of setups you want to take through a solid plan and some study, then finding your patience at the trading screen becomes easier. When your patience pays off with a good trade (it doesn’t have to be a winner to be a good trade) it reinforces your discipline and increases your ability to be patient in the future.

The real trap is when you lose that patience and start to take bad trades you know you shouldn’t take. Normally you know right away when you’ve made these decisions. You feel uneasy being in the trade or even start to panic. If a bad trade loses, it very often leads to another impatient decision and further losses. This is a cycle that any novice trader must be aware of to have hopes of developing out of it.

This gives the trader some important questions to ask:

How do you make sure your focus remains on the big picture during the day and doesn’t become too narrow?

What tools do you use to guage the momentum in the market and either trade with it or use it to minimize your trading risk?

In what ways can you develop your patience as a trader outside of just screen time? Are there other activities you can do to develop this skill and make yourself a more effective trader?